Helping Consumers Navigate Tariffs

Strategic Insights for Brands

by Jeremy Cochran, Jamie Baker-Prewitt, and DeWayne Ray

As the U.S. continues to experiment with tariff tactics deeper into 2025, targeting a wide array of imported consumer goods, American shoppers are taking notice. Given the breadth of categories affected by tariffs (from automobiles and electronics to apparel and groceries), consumers are feeling anxious about how they will impact their wallets, and brands are being forced to adapt quickly.

To shed light on this evolving landscape, we asked consumers about their attitudes towards, and reactions to, these tariffs in a survey of 600 U.S. consumers across demographic groups. Our findings offer a timely window into consumer awareness, attitudes, and behavioral shifts—and provide key implications for marketers, strategists, and supply chain leaders as they make decisions in a dynamic environment.

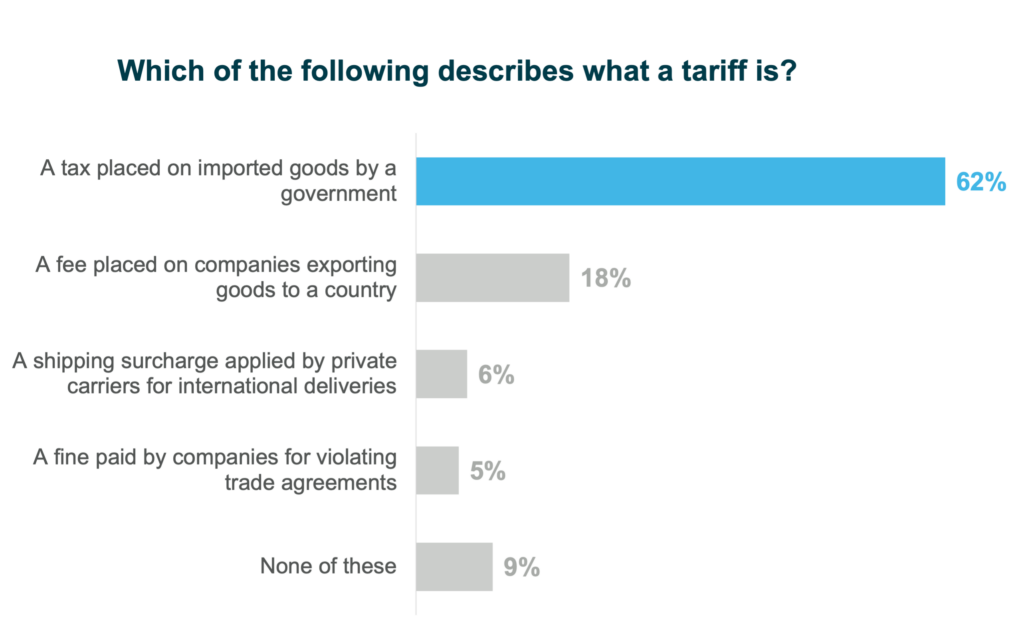

Consumer Tariff Understanding: Better Than Before, But Still Uneven

While tariffs remain a complex policy issue, many Americans now understand the basics. According to our recent research, 62% of Americans correctly identify what a tariff is—a tax placed on imported goods.1 This is an increase from years past where less than half of consumers could correctly identify a tariff.2 However, nearly a third of consumers remain confused, and this misunderstanding may affect how consumers attribute the causes of rising prices, which in turn can influence brand trust.

Source: Burke, Inc. (April 2025). Burke Omnibus Research Program.

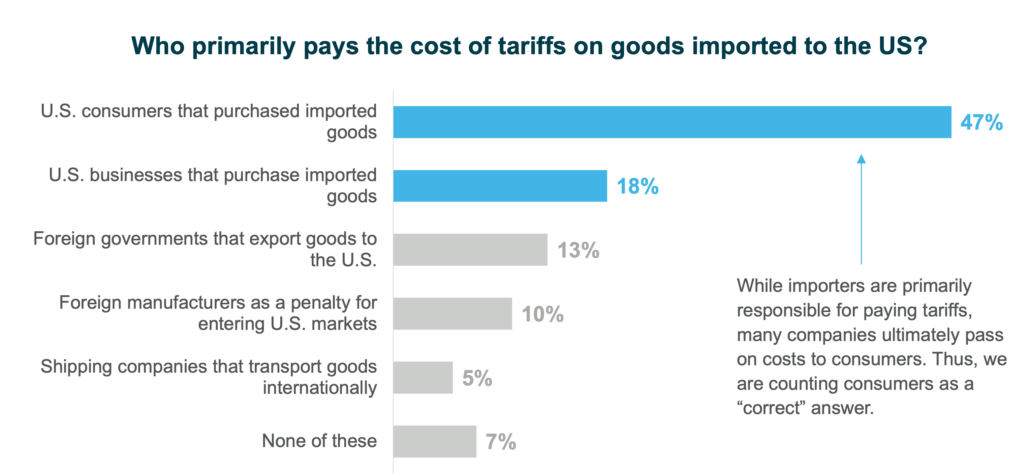

Additionally, about two-thirds of consumers correctly point out that tariffs are primarily paid for by domestic parties, not other countries or foreign businesses. Some are confused about who exactly pays tariffs: about half of consumers think consumers themselves directly pay the costs of tariffs, while only 18% correctly note that U.S. importing businesses pay tariffs. However, given that the importing businesses often (but not always) pass the tariff costs onto consumers, perceiving that consumers pay tariffs is not too far from reality.

Source: Burke, Inc. (April 2025). Burke Omnibus Research Program.

Overall, as tariffs remain a focus in the news, consumers are becoming more aware of what tariffs are and who bears the cost. But the awareness is not universal, so consumers may still become confused about why prices might rise.

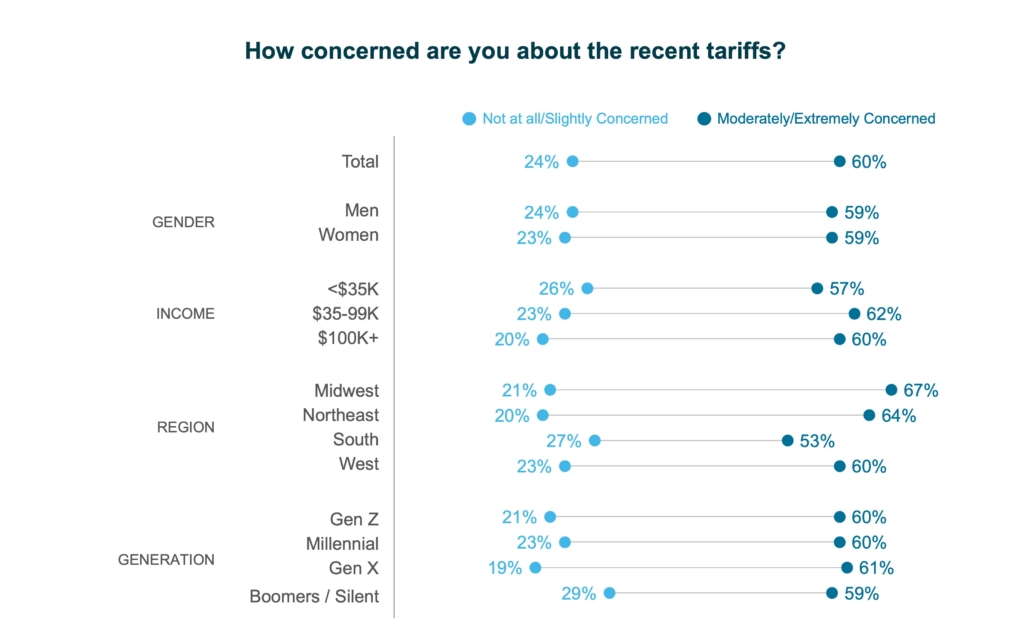

High Concern—Especially for Parents

Across the board, 60% of U.S. consumers report concern about tariffs, with nearly 40% indicating they are seriously concerned. Consumers with children in the house are especially worried as these households likely face increasing costs as their children grow.

Additionally, concern about tariffs is higher in the Midwest and Northeast and lower in the South. These regional differences may reflect political alignments of the regions as well as proximity to industries that may be impacted by the tariffs.

Source: Burke, Inc. (April 2025). Burke Omnibus Research Program.

These findings reflect a broader trend seen in national data: surveys by Gallup and Ipsos show that a strong majority of Americans believe tariffs result in higher prices for everyday goods.3 4

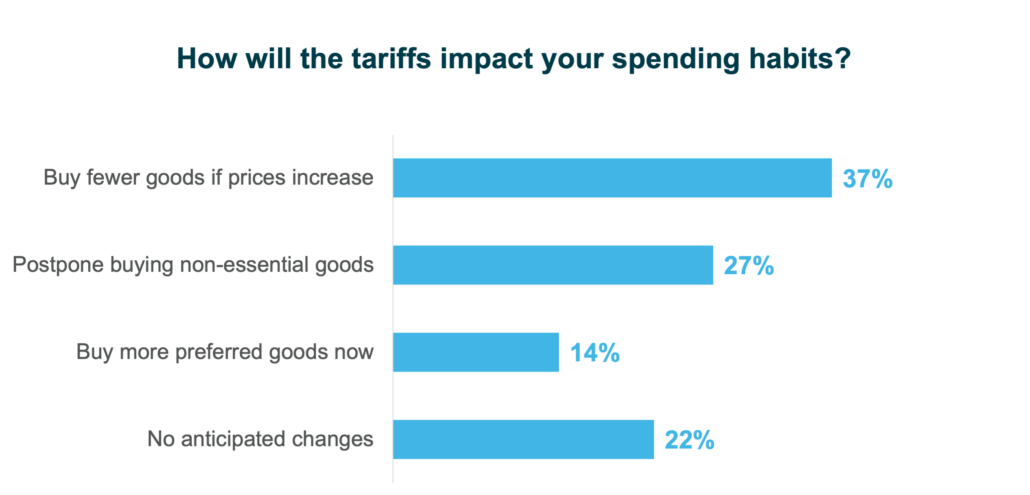

Spending Behavior: A Nation Bracing for Impact

The most common consumer response to tariffs is pragmatic restraint. Our research indicates that 37% of Americans are reducing their spending in anticipation of tariff-related price increases, and 27% are postponing non-essential purchases. This suggests a widespread shift toward more cautious, value-driven consumption.

Interestingly, anticipated actions vary by income and age:

- Higher-income households are more likely to “stock up now” to beat price increases—a forward-looking strategy that reflects both awareness and financial flexibility.

- Older consumers, by contrast, are less likely to change their shopping habits, possibly due to ingrained habits or greater financial stability.

These results align with broader national indicators showing that a large majority of Americans are adjusting their spending habits in light of rising prices.5 Other surveys reveal growing interest in discount retailers, secondhand goods, and store-brand alternatives.6

Source: Burke, Inc. (April 2025). Burke Omnibus Research Program.

Product Category Understanding and Misperceptions

When we asked which categories are likely to be affected by tariffs, respondents correctly identify key sectors: groceries, automobiles, electronics, clothing, and appliances.

These expectations are likely driven by both media coverage and firsthand experience, particularly as price increases have already been observed in these areas. However, notable blind spots remain, like toys and games. Consumers tend to underestimate the impact of tariffs on toys, even though this category is highly reliant on imports from countries like China and Vietnam, and the expected impact on toy prices has been discussed prominently in U.S. media.

Toy industry groups have sounded the alarm, noting that nearly 96% of U.S. toy companies are small- or medium-sized, and many are struggling to absorb rising costs without raising prices or cutting jobs.7 Consumers’ lack of recognition about the impact tariffs might have on this industry may be an additional unwelcome shock to consumers.

Strategic Implications for Brands

Given the current landscape, what should brands do?

1. Communicate With Clarity and Empathy

One of the most important approaches companies can take is to prioritize transparency and empathy. When prices rise, consumers want to know why. Brands that clearly explain tariff-related costs—whether via receipts, signage, or digital messaging—could build trust and preserve loyalty. Burke’s research on brand strength found that companies known for promoting authentic and consumer-centric messaging outperform those less known for this type of corporate advocacy.8 Direct-to-consumer watch brand Christopher Ward is committing to clearly noting the 10% tariff charge on the checkout screen and promises to absorb costs of additional tariff increases on pre-orders that occur between order and delivery.9

However, brands must craft these messages carefully so as not to seem callous or as if they are avoiding responsibility. Consumers expect brands to understand their financial situation and make some effort to ease the impact.

Communicating what actions the brand is taking to help reduce the overall consumer cost is crucial to being seen as empathetic and caring.

2. Reinforce Value Without Diluting Brand Equity

Consumers are trading down—but they still want high quality. Brands should consider offering:

-

- Smaller pack sizes

- “Value” lines or bundles

- Flexible payment options (e.g., Buy Now-Pay Later, installment payments, etc.)

While some price increases are unavoidable, strategic promotions can help blunt the impact. According to a 2025 marketing survey, 52% of retailers are increasing free shipping or bundling offers, while 49% are expanding loyalty programs to maintain engagement in response to the tariffs. 10 Other brands are promoting discounts now to encourage buying before tariffs take effect: Burlap & Barrel, a spice brand, ran a “tariff sale” with discounted products to great success.11

3. Localize When Possible, and Communicate It

Some companies are responding by re-shoring production and conducting final assembly in the U.S., which can allow products to avoid tariffs and carry a “Made in America” label. Western wear brand Filson reopened a manufacturing facility in Seattle to boost its U.S.-based production and recently launched a “Made in the USA” section on its website, prompting an immediate spike in sales.12 Not all companies can consider this solution given the cost implications, but any efforts towards re-shoring production could help offset tariff charges and, if communicated appropriately, gain positive sentiment from U.S. consumers.

Final Thoughts

Consumers are not yet panicking about tariffs, but they are concerned and preparing. The 2025 tariff environment is likely to reshape how Americans spend, shop, and assess value. Even with some recent court decisions questioning the legality of the recent tariffs, the impact of tariffs is unlikely to subside completely. Data from Burke’s Omnibus Research Program makes one thing clear: understanding consumer psychology around tariffs is essential to navigating the months ahead.

For consumer brands, this moment presents both risk and opportunity. Brands that can craft a strategy early, communicate clearly, and adapt intelligently will not only weather the storm but could emerge stronger by earning the trust of more informed and more deliberate shoppers.

Jeremy Cochran, PsyD is Burke’s Research and Development Manager. As an analytics and strategy leader with over 15 years of experience in the insights industry, Jeremy has a passion for finding new ways to solve problems and gain insights.

Jamie Baker-Prewitt, PhD is Chief Research Officer at Burke. She helps organizations make sound business decisions using science, pragmatism, and psychology.

DeWayne Ray is Vice President within Burke’s Account Management team. With over 25 years in research, he partners with clients to apply best-in-class practices along with cutting-edge innovations to reveal fresh insights that enable retention and growth.

Interested in reading more? Check out Jamie and Jeremy’s other articles:

Disrupt Consumer Decision-Making to Realize Growth

Insights Today: Leveraging Data Abundance

As always, you can follow Burke, Inc. on our LinkedIn, Facebook and Instagram pages.

Sources:

1. Burke, Inc. (April 2025). Burke Omnibus Research Program.

2. Ipsos/Statista Poll. (Dec 2024). “Only 45% of Americans Know What a Tariff Is.” https://www.statista.com/chart/33863/share-of-respondents-who-think-the-following-definition-of-tariffs-is-accurate/

3. Brennan, M. (2024). “Americans Skeptical of Benefits of Tariffs.” Gallup News. https://news.gallup.com/poll/660002/americans-skeptical-benefits-tariffs.aspx

4. Reuters/Ipsos Issues Survey, December 2024. https://www.ipsos.com/en-us/reutersipsos-issues-survey-december-2024

5. PYMNTS.com. (May 2025). “Shoppers Pull Back as Half of US Consumers Expect Tariffs to Raise Prices at Double the Rate of Inflation.” https://www.pymnts.com/study_posts/shoppers-pull-back-as-half-of-us-consumers-expect-tariffs-to-raise-prices-at-double-the-rate-of-inflation/

6. Bid-on-Equipment. (Jan 2025). “Over 2 in 3 Americans Changing Shopping Habits in 2025 Due to Potential Tariffs.” https://www.bid-on-equipment.com/post/tariff-impact-survey

7. The Toy Association. (18 April, 2025). “Christmas and Toy Companies are at Risk! Toy Association Member Survey Reveals Alarming Impact of 145% Tariffs.” https://www.toyassociation.org/PressRoom2/News/2025_News/toy-association-member-survey-reveals-alarming-impact-of-145-percent-tariffs.aspx

8. Burke, Inc. (November, 2022). Brand Strength R&D Survey.

9. Watch Aficionados. (23 April, 2025). “An update on tariffs and deliveries for the USA – Christopher Ward.” https://watchaficionados.net/an-update-on-tariffs-and-deliveries-for-the-usa-christopher-ward/

10. Wunderkind. (May 2025). “The U.S. Tariff Effect: Marketer Reactions & Revenue Strategy in 2025.” https://convert.wunderkind.co/2025-may-tariffs-report/

11. Smith, A. (16 April, 2025). “More brands turn to ‘tariff sales’ to drive demand before prices increase.” Modern Retail. https://www.modernretail.co/marketing/more-brands-turn-to-tariff-sales-to-drive-demand-before-prices-increase/

12. Morris, M. (14 April, 2025). “How Made-in-America Brands Turn Tariff Turmoil Into Opportunity.” Business of Fashion. https://www.businessoffashion.com/articles/retail/how-made-in-usa-brands-benefit-from-tariffs/

Feature Image – ©Prostock-studio – stock.adobe.com