A Spectrum of Segmentations: Maximizing Marketplace Insights Now and in the Future

by Thomas Mills and Jim Doolittle

Perspective is power—to turn “what is” into “what can be.” And while it’s not always easy to embrace a new way of looking at things, “change” is often the constant we can count on. So it behooves us—as innovators and thought leaders—to put a new lens on old challenges. Because opportunity never looks the same for very long.

“If you change the way you look at things, the things you look at change.” Dr. Wayne Dyer

Applying this principle of innovation to marketing strategy, the tools businesses use to inform marketing and overall strategic planning must evolve. That evolution suits one indispensable tool for businesses: market segmentation.

In this article, we’ll explore a brief history of market segmentation, with its variety of applications, benefits, and shortcomings, and introduce a new framework: a spectrum of segmentations that focuses on different stages of the evolving marketplace to help maximize current customer engagement, targeting to find the next customer, and powering innovation and new product development for the future.

Market segmentation research has a longstanding history of guiding various elements of marketing strategy:

- Who to target: targeting all (potential) consumers is not only inefficient but ineffective

- What to offer: ensuring the right solution is built to meet consumer needs

- How to communicate: identifying message and channel strategies that will resonate most with different groups of customers

The use and evolution of market segmentation is inextricably linked to the availability of empirical data. Today, marketers and sales teams have a surplus of facts and figures about their consumers at their fingertips. While segmentation analysis has evolved over the decades to accommodate these different forms of data, the framework for thinking about segmentation research has not.

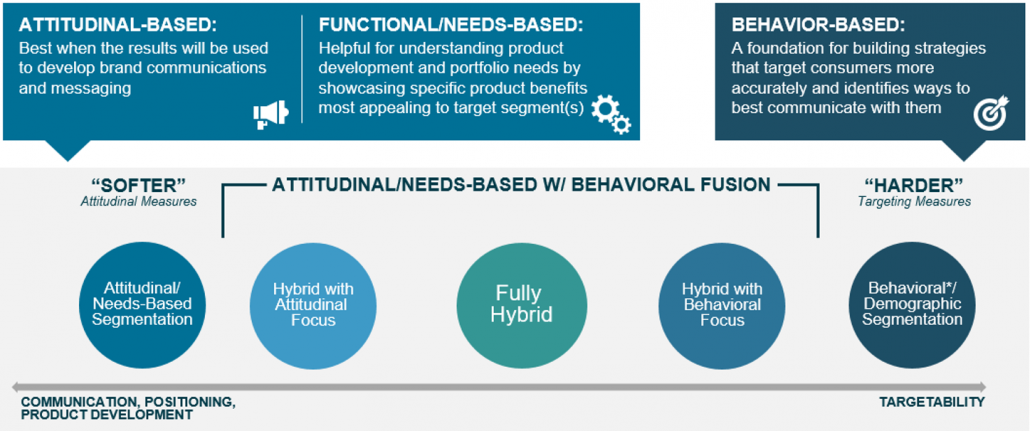

Historically, we have thought about segmentation research as taking place on a continuum rooted in the type of empirical data used to define the segments. This continuum ranges from fully attitudinal or needs-based to exclusively behavioral/demographic.

Just as segmentation research helps translate an array of information into distinct, relatable groups, this framework provides a very informative guide for determining the type of segmentation research a company should undertake. However, there are often competing voices in this discussion. Often, marketers want to understand what consumers think (what makes them tick), while sales teams prioritize knowing what consumers look like, what they do, and where to find them. On the other hand, insights professionals see the vast dimensions that split a market, but they need to know business objectives and practical limitations in order to be helpful consultants in this segmentation journey. The following scenarios illustrate these challenges.

Too Much Attitude

A pharmaceutical company wanted to understand the market of potential patients for a new therapeutic. The segmentation solution presented was grounded exclusively in attitudes and needs, as the primary end-user for the segmentation was Marketing. The resulting set of segments delighted the marketing team, as segments separated on different needs and addressable barriers. However, this solution was not well-received by the sales team because it did not offer a way to identify these patients in the real world.

Too Few Insights

A medical supplier company wanted to understand which businesses (e.g., hospitals, labs, pharmacies, etc.) would be optimal targets in terms of interest in outsourcing certain services. Given the primary client for the segmentation was Sales, the solution presented differentiated businesses primarily regarding their current outsourcing behavior and type of business. While this solution offered clear “who to go after” implications for the sales team, it did not provide enough information on how the client could position themselves as the medical supplier, or whether they even had permission to do so.

Just Right

A pet food company deployed segmentation research to identify and understand macro trends in the marketplace and (re-)position a growing portfolio of brands. As such, they needed to gain a greater understanding of how products were being used, what needs were being and not being fulfilled, and white space metrics. The segments that were ultimately chosen were purposefully crafted using a blend of behaviors, demographics, and current needs and future opportunities. As a result, the solution itself offered segments that spoke sufficiently about how the marketplace was expected to evolve, providing powerful insights to guide marketing, brand strategy, and sales teams to their new positions for the portfolio of brands. And, yes, all teams were satisfied.

Acknowledging the shortcomings of segmentation is not enough. We must evolve our current framework to consider a wider spectrum of segmentations, one that helps us more effectively understand the:

- Current marketplace (current customers),

- Growth marketplace (new and lapsed customers), and

- Future marketplace (future customers)

The Segmentation Spectrum

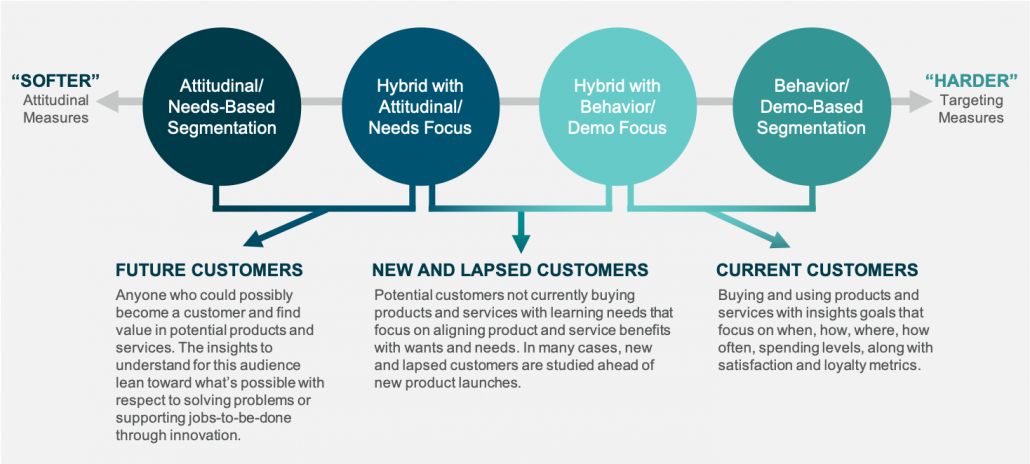

While the attitude/needs-to-behavior/demography continuum has served us well through the years, we can improve the framework by considering the focal audiences referenced above.

- Future Customers: This is a unique audience with a plentiful representation of anyone who could possibly become a customer and find value in potential products and services. The insights to understand for this audience lean toward what’s possible with respect to solving problems or supporting jobs-to-be-done through innovation.

- New and Lapsed Customers: This audience represents potential customers not currently buying products and services with learning needs that focus on aligning product and service benefits with wants and needs. In many cases, new and lapsed customers are studied ahead of new product launches.

- Current Customers: This audience represents customers currently buying and using products and services with insights goals that focus on when, how, where, how often, spending levels, and satisfaction and loyalty metrics.

Our evolved segmentation spectrum framework provides an optimized alignment to maximize the power of the segmentation. When it’s available to internal teams, there is a better connection with each team’s target audience and the information obtained for each segment to support decision making.

Stay Tuned

We have briefly introduced an evolved framework – the Segmentation Spectrum – to optimize approaches to segmentation research. The Spectrum enables alignment on what needs to be understood, who is the best target audience, and the critical internal teams tasked with implementing and activating change following the segmentation. Over the next several months, we will elaborate on the application of the Spectrum to leverage segmentation to its fullest potential. We hope you will stay for the journey.

As a senior vice president at Burke, Thomas leads complex research engagements partnering with clients and with support of a team of expert data scientists and researchers. Thomas also serves as Burke’s Subject Matter Expert (SME) for segmentation.

As a senior vice president at Burke, Thomas leads complex research engagements partnering with clients and with support of a team of expert data scientists and researchers. Thomas also serves as Burke’s Subject Matter Expert (SME) for segmentation.

As a senior consultant in Burke’s Decision Sciences function, Jim serves as an advisor to project teams offering his expertise in research design, execution, data modeling, and insights creation.

As a senior consultant in Burke’s Decision Sciences function, Jim serves as an advisor to project teams offering his expertise in research design, execution, data modeling, and insights creation.

As always, you can follow Burke, Inc. on our LinkedIn Twitter Facebook and Instagram pages.

Source: Feature Image – ©rawpixel.com – stock.adobe.com