Millennials Win Again

How to win with millennials during and after COVID-19

by James Sorensen

I am a Gen-Xer, part of the “forgotten generation.” After spending decades focusing on Boomers, marketers skipped Gen-X and instead spent the last decade focusing on Millennials. We Gen-Xers have tried to make the argument that we changed the world with MTV, 80s rock, parachute pants, and big hair, but the marketing world hasn’t listened. Millennials have been one of the most important cohorts for the past decade, and after scouring COVID-19 shopping data, I have concluded that they will continue to grow in importance for retailers and brands. Drat…even in our prime earning years, Gen-X can’t get respect.

WHY ARE MILLENNIALS THE FOCUS?

Millennials are a large group with ample spending power. In 2019, Millennials surpassed Boomers as the largest generation (72.1 vs. 71.6 million people). While Gen-X only includes 65.2 million people, the group is forecast to surpass Boomers in 2028!1 Millennial spending power is expected to reach $8.3 trillion by 2025 as compared to $6.4 trillion for Gen-X and $1.1 trillion for Boomers.2

While a large generation, Millennials are also unique – which makes them more interesting to target. And they have always shopped differently than other generations. Millennials are digital-forward shoppers – they are heavy users of mobile devices, social media, and online shopping. However, Millennials also prioritize physical stores as an experiential destination. They expect a pleasant, engaging in-store environment that encourages product interaction and trial before purchasing. Lastly,Millennials have a unique relationship with pricing and value(s). Many expect competitive pricing, as their digital savviness leads to price transparency, but they are willing to pay more for products that deliver greater value. Value can mean superior benefits, but Millennials also will spend more to shop retailers and brands that reflect their personal values.

HOW ARE MILLENNIALS SHOPPING DIFFERENTLY DURING COVID-19?

Digitally-forward Millennials lead ecommerce acceleration, but shopping experiences are subpar.

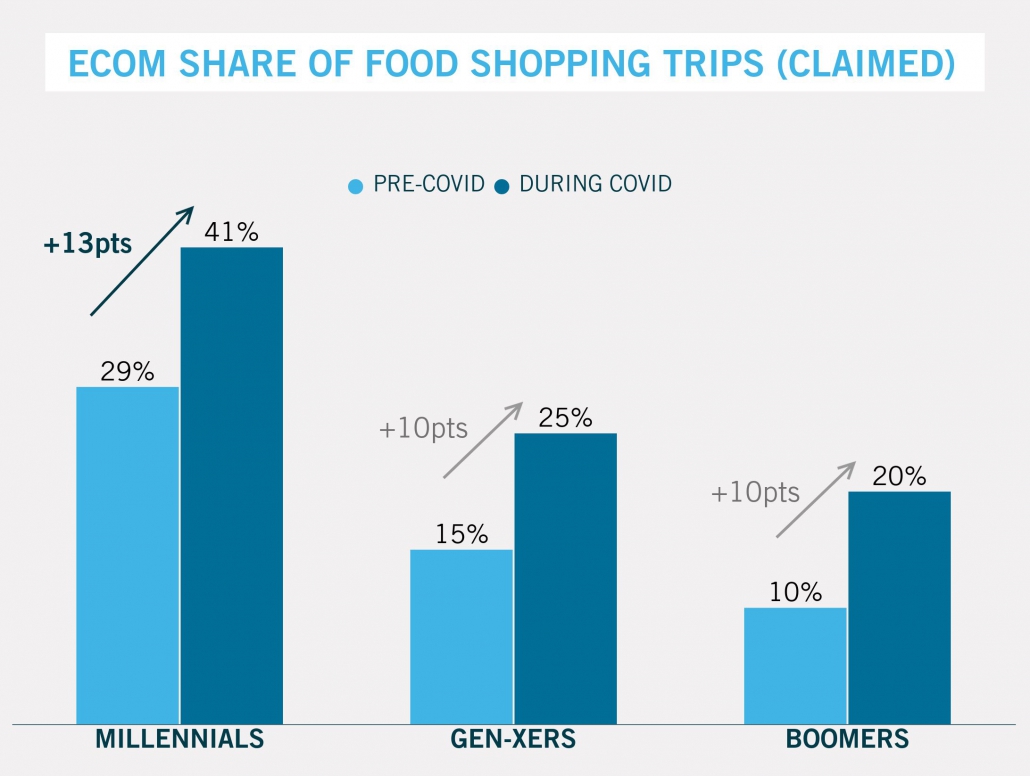

Accelerated ecommerce growth has been the biggest change in retail during the COVID-19 lockdown, and Millennials are the driving force behind this increase. In a recent Burke COVID-19 study, Millennials were found to not only represent the largest share of ecommerce food buyers (29% of trips claimed pre-COVID), but also the most growth of share during the pandemic (13pts).

As digitally-forward shoppers, Millennials are more open to new digital experiences. Many have embraced the opportunity to buy groceries online for the first time (22%), even if they had not shopped online before.

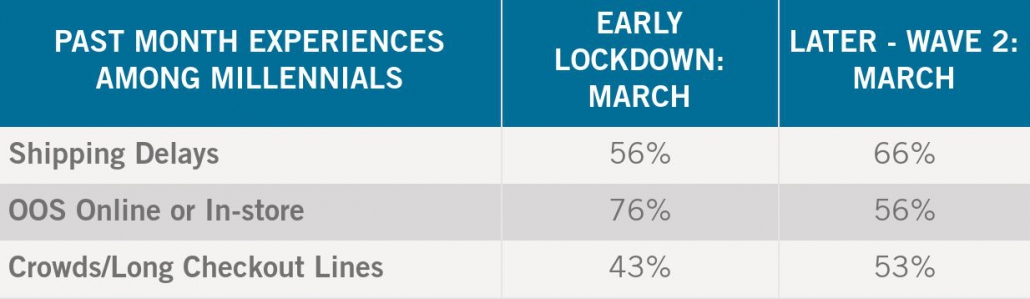

Millennials expect more from their shopping experiences, both in-store and online. Retailers and brands have not delivered ideal shopping experiences during the pandemic, and experiences have not improved much over the past three months. Out-of-stocks, shipping delays, long lines, and crowded stores continue to plague retailers, even after several months of lockdown.

Digital and mobile are more important for Millennials during the COVID-19 lockdown, but in-store engagement is evolving.

Burke’s COVID-19 study indicates mobile devices will be critical in-store touchpoints, as 24% of Millennials say they are more likely to use their device to look up information. Millennials continue to shop differently and be more engaged with brands and retailers. As they leverage digital devices and social media more often during COVID, they are more likely to do their own research and pay more attention to advertising.

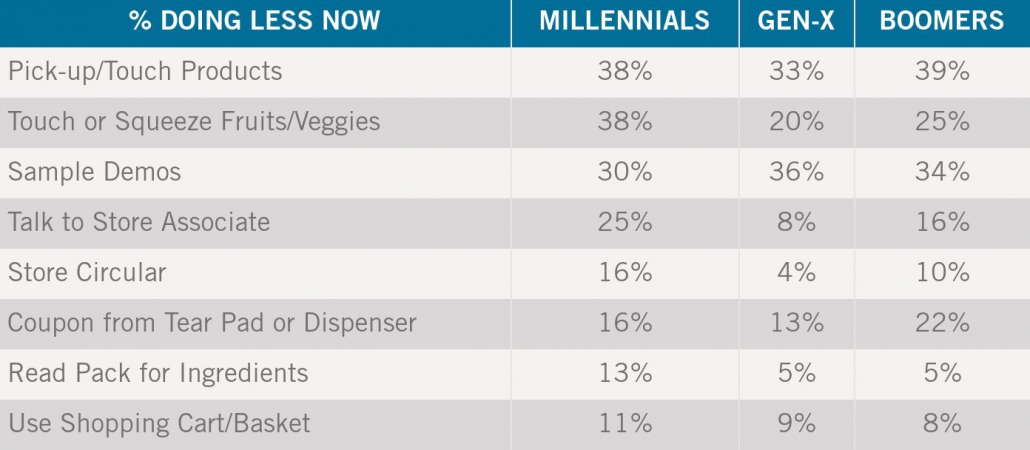

Previously, Millennials have been uniquely demanding of an interactive, engaging in-store experience. This could prove to be retailers and brands’ biggest challenge post-COVID. Millennials are more cautious of engaging with the retail environment while shopping during the pandemic. However, their use of traditional, paper-based point-of-sale materials has not been as negatively impacted, suggesting these behaviors are more likely to return.

Millennials remain price/value focused, but also offer risks and opportunities for brands.

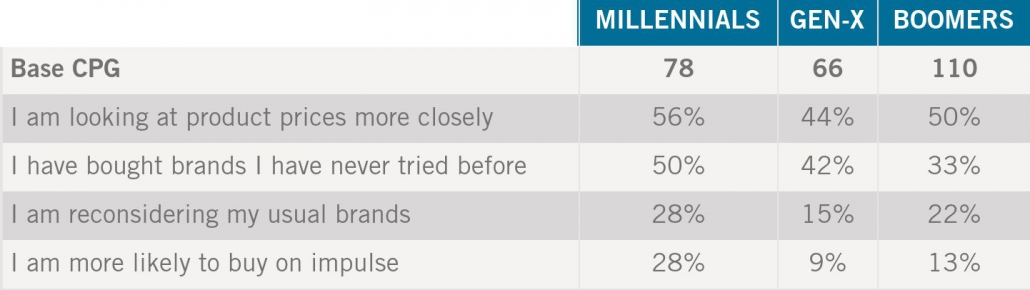

Millennials continue to expect price transparency as they use their devices to check prices more closely. This behavior will become even more important as lockdown shopping migrates to recessionary shopping.

Burke’s COVID-19 study found that Millennials are more likely to try new brands, as well as buy brands on impulse. With brand loyalty lower among Millennials, this provides brands with some risks but also opportunities.

HOW TO WIN WITH MILLENNIALS DURING AND AFTER COVID

To prepare for future wins, retailers and manufacturers must work to improve both the in-store and online shopping experience. All shoppers, particularly Millennials, will reward those who differentiate and deliver an engaging experience.

Here are some thought starters for actions that retailers and brands should consider:

![]() Fix supply chains to improve the retail experience. Long lines, delays, and out-of-stocks must continue to improve. As we move closer to “normal,” Millennials will reward retailers and brands who provide the most rewarding in-store experiences.

Fix supply chains to improve the retail experience. Long lines, delays, and out-of-stocks must continue to improve. As we move closer to “normal,” Millennials will reward retailers and brands who provide the most rewarding in-store experiences.

![]() Double down on digital, store associates, and in-store POS. Physical stores will remain important, but shoppers will engage with them differently. Being comfortable touching and trying out products in-store will continue to pose a challenge, particularly for Millennials who value this engagement so much. Brands and retailers should leverage traditional POS and store associate training programs, and focus on creating new experiences on mobile devices. Voice-activated displays and other low or no-touch experiences can help customers re-engage.

Double down on digital, store associates, and in-store POS. Physical stores will remain important, but shoppers will engage with them differently. Being comfortable touching and trying out products in-store will continue to pose a challenge, particularly for Millennials who value this engagement so much. Brands and retailers should leverage traditional POS and store associate training programs, and focus on creating new experiences on mobile devices. Voice-activated displays and other low or no-touch experiences can help customers re-engage.

![]() Elevate online engagement. Before the pandemic, poor online shopping experiences led to only 5% of CPG and 20% of non-CPG sales via this channel. Now it is even more critical that online retailers do a better job of engaging their shoppers. Brands and ecommerce retailers must build experiences so that consumers don’t feel the need to visit the store before they buy. Smarter use of product images, video, comparison tools, and other enhanced content are critical to win Millennials online. Read my blog post here for more details on improving the ecommerce shopping experience.

Elevate online engagement. Before the pandemic, poor online shopping experiences led to only 5% of CPG and 20% of non-CPG sales via this channel. Now it is even more critical that online retailers do a better job of engaging their shoppers. Brands and ecommerce retailers must build experiences so that consumers don’t feel the need to visit the store before they buy. Smarter use of product images, video, comparison tools, and other enhanced content are critical to win Millennials online. Read my blog post here for more details on improving the ecommerce shopping experience.

Niels Bohr, one of the foremost physicists of the 20th century, sardonically said: “Prediction is very difficult, especially if it’s about the future.” As we navigate through change, we need to make predictions, which is difficult and challenging. To guide decisions about changes in retail, Millennials are a great proxy for understanding the needs of the ‘future shopper.’

SOURCES:

- https://www.pewresearch.org/fact-tank/2020/04/28/millennials-overtake-baby-boomers-as-americas-largest-generation/

- https://www.mckinsey.com/industries/retail/our-insights/cracking-the-code-on-millennial-consumers

James Sorensen is a thought leader, helping shape the future of retail and shopping. As SVP and retail/shopper consultant, James helps clients innovate new omni-commerce retail experiences by first uncovering deep insights about the shopper, and then applying a proprietary innovation process that leads to pragmatic solutions that drive growth.

Interested in reading more? Check out James’ other articles:

COVID-19 is the Disruption Marketers Have Been Waiting for

In a Post-COVID World, Will Ecommerce Growth Continue?

As always, you can follow Burke, Inc. on our LinkedIn, Twitter, Facebook and Instagram pages.

Sources: Feature Image – ©DisobeyArt – stock.adobe.com